Break Even Analysis

Small Business Department

Break-Even Analyses … What is It and Why in the World do I Need It?

By Alan Sartain

A break-even analysis is a very useful tool if you are starting up a new business, planning to expand your existing business or even thinking about a new advertising or marketing campaign. Simply put, it can help you understand whether your next big decision will help you realize your dreams or be the beginning of the end for your business.

According to financial textbooks, fixed costs would be those that you would pay even after you closed the business down, such as lease costs, interest and other costs you could not cancel. I suggest instead that you change that definition for this analysis and use your average running costs (including payroll, telephones, utilities, etc.) instead of fixed costs. This produces a more practical break-even point, which is the level of sales required for breaking even with your average running costs.

Once you know what your variable costs are, as well as your overall fixed costs for your business, you can determine your break-even point: the volume of sales needed to at least cover all of your costs. A break-even analysis also enables you to compute a new break-even point that you’d need to meet if you decided to increase your fixed costs (for example, if you underwent a significant new expansion project or bought some new office equipment.)

You will need the following information and calculations:

Fixed costs. Fixed costs or overhead, using the above definition, are expenses that do not vary much from month to month. They include rent, insurance, utilities, and other set expenses.

Sales revenue. The total dollars from sales activity that you bring into your business each year. To perform a reliable break-even analysis, you need to base your forecasted sales on what you truly expect, not on what it would take to make a good profit.

Cost of goods sold. The total cost of each item sold summed up for all items sold throughout the entire year.

Average dollar sale. This is your total sales revenue divided by the total number of invoices or purchases made by your customers. This is important to determine how many customer transactions you will have to sell to reach break-even.

Your break-even point can be determined by using the following formulas:

- Sales Revenue – Cost of Goods Sold = Gross Margin.

- Fixed Cost / Gross Margin = Break-Even Sales.

- Break-Even Sales / Average Dollar Sales = Break-Even Transactions.

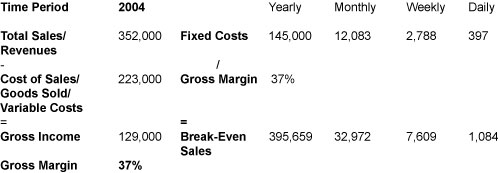

I use the following simple break-even spreadsheet. Your Action Coach will be happy to email you this spreadsheet.

Break-Even Calculator

1st Calculate your gross margin: the percentage of each dollar you sell that stays with you to pay for overhead.

2nd Calculate your break-even sales: the total sales you need to break-even on your fixed costs.

3rd Calculate your break-even transactions: the total # transactions you need to reach break-even sales.

What a Break-Even Analysis Tells You

A break-even analysis shows you how much revenue you will need to bring in before you make a penny of profit. If you can attain or exceed your break-even point, then your business stands a good chance of making money. Just make certain that you are comfortable with your projections. It is far wiser to err on the conservative side.

Many seasoned entrepreneurs use a break-even analysis as a primary screening tool for new business ventures. They won’t write a business plan unless their break-even forecast shows that their projected sales revenue far exceeds their costs.

If You Can’t Break-Even

If you are comfortable that you have made good projections and you still can’t break-even, then you must either forgo the expansion or find a way to improve your gross margin through price increases or cost reductions. If this is not possible, do not spend the money.

The Future is Bright

Opportunities abound for savvy business people. Now is the time for expansion and growth. As long as you are satisfied with what your business expansion —whether in people, capital or marketing investment — will likely yield, make the investment. The break-even analysis can help you determine your next move.